Bookkeeping and payments move in together (finally)

Your AP and expenses headaches cured

Apron is the home of your entire financial operations workflow. It keeps you and your clients moving as one, with less admin and chasing, and more clarity and control.

Disconnected bookkeeping

Old way

Apron

New way

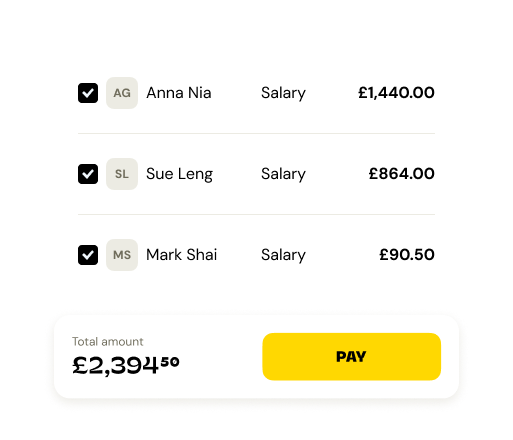

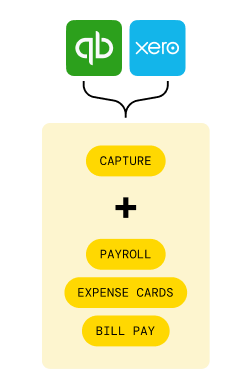

Capture +

Capture + everything accountants, bookkeepers and clients need to manage money out

01

Invoice capture with added power. No more manual data entry, no more waiting, no more chasing your clients.

02

Make it easy for clients to see and manage money out, with bills, payroll and expenses together in one place.

Built for practices like yours & all the clients you serve

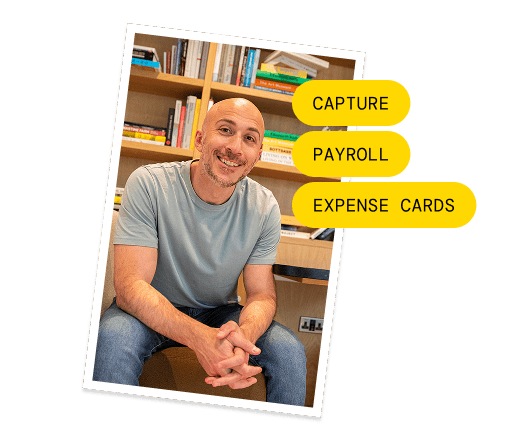

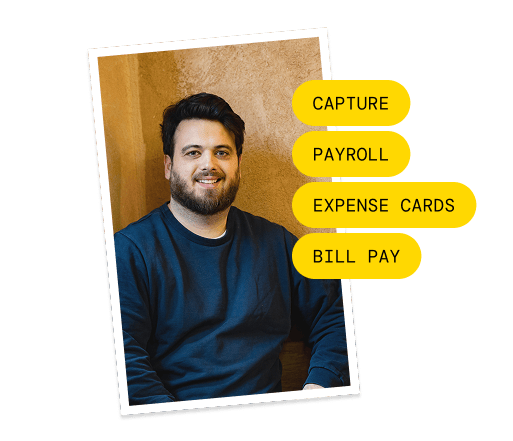

Whether you're doing light-touch bookkeeping or running an entire finance function, Apron flexes to fit your practice model and client needs.

From kitchens to creative agencies, Apron works

Why practices choose Apron

Works with the tools you already use

Syncs with Xero and QuickBooks. Connects to client banks and emails.

Built for how accountants actually work

Set custom approval flows, define roles, and work across all your clients from one login.

Keeps you and your clients in sync

Comments, reminders, and approvals — all in one shared view.

“Apron has become an app that I can't be without. I love it, my clients love it and it has given us back hours of valuable time.”

Lora Cannon,

Lora Cannon, Focus Bookkeeping

Join the Apron (Books Club)

The more you and your clients use Apron, the more rewards you both unlock.

Points required